Taxflow

Rely on an integrated cloud-based tax engagement solution that simplifies tax workflow

Request a demo

Effortless tax workflow for efficiently completing your tax engagement

Tax workflow can be daunting with time-consuming calculations, and the fear of making errors can cause unnecessary stress. Most tax workflows struggle with outdated and manual processes, but the need for evolving the process through automation is imminent.

As the global technology leader in the accounting and auditing space for more than three decades, Caseware has harnessed the power of data ingestion and client collaboration in a game changing application.

Caseware Taxflow is a complete cloud-based tax workflow app designed to revolutionize the way you manage your taxes. It offers smart automation, intuitive interfaces for real-time collaboration and secure data storage, ensuring your financial information is protected. It streamlines your tax workflow, reduces errors, allows import of financial data effortlessly, simplifies calculations and generates accurate tax results that saves valuable time, and files with confidence.

Features

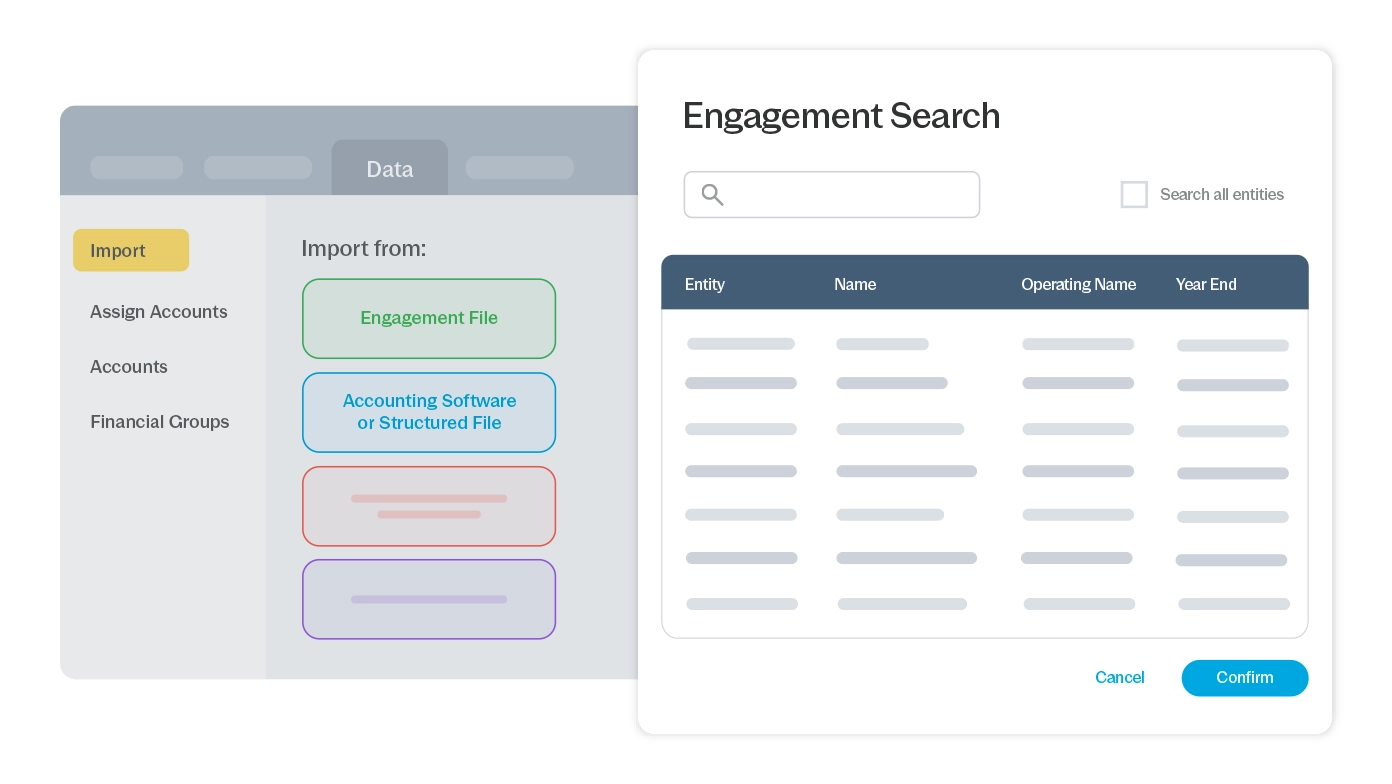

Effortlessly import and integrate your financial data with seamless data ingestion

Effortlessly import data from various sources, including Working Papers engagement files, Excel/CSV formats, and supported Accounting Packages, whether they are desktop-based or cloud-based. Our seamless integration capabilities enable you to bring in final trial balance data from a range of sources such as OnPoint EBP, OnPoint Audit, OnPoint PCR or OnPoint DAS engagement files with ease for a smooth and efficient workflow.

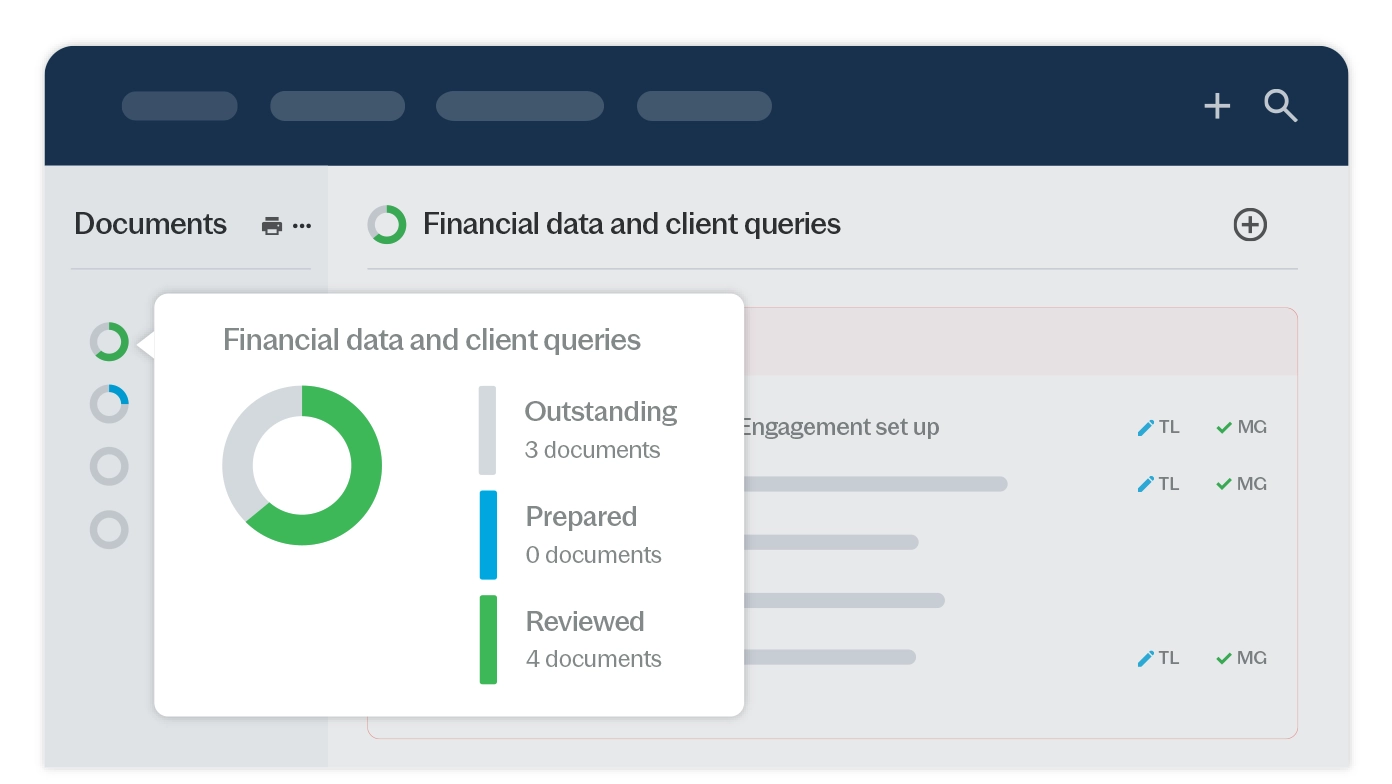

Unlock efficiency and control with engagement management by your side

This intuitive app streamlines your engagement workflow by leveraging real-time status updates, allowing you to stay in complete control and up-to-date on the progress and status of your engagements at all times.

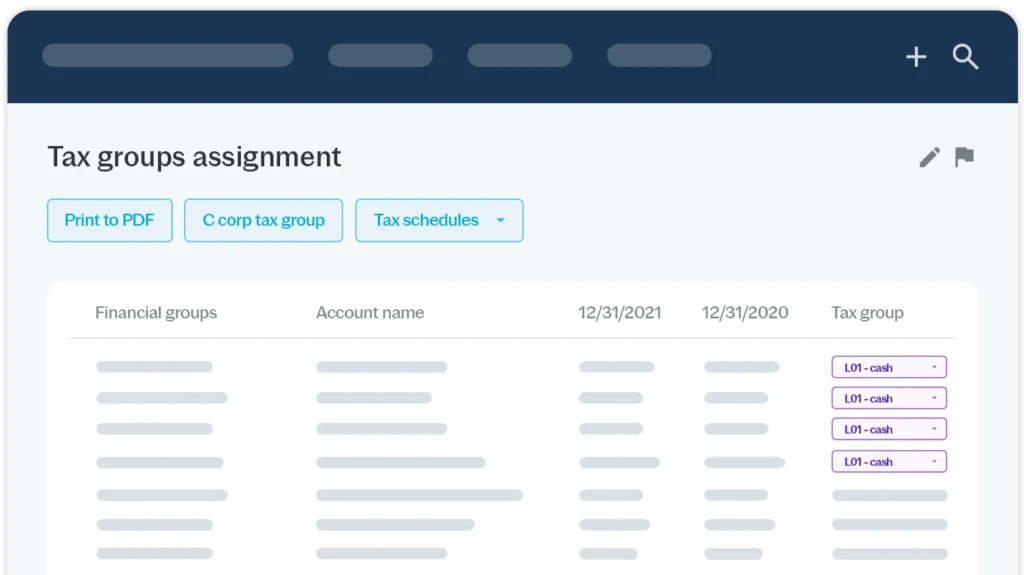

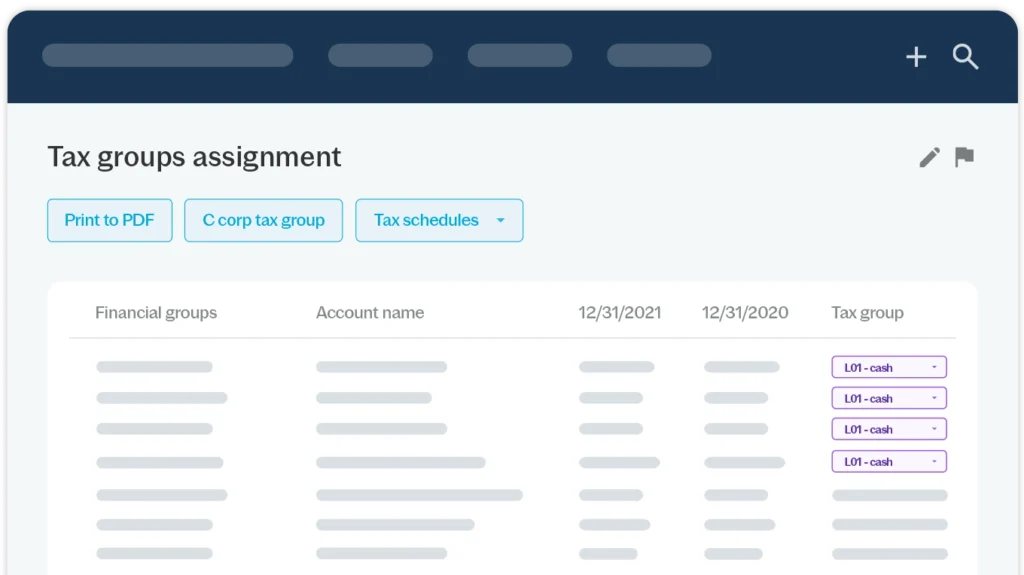

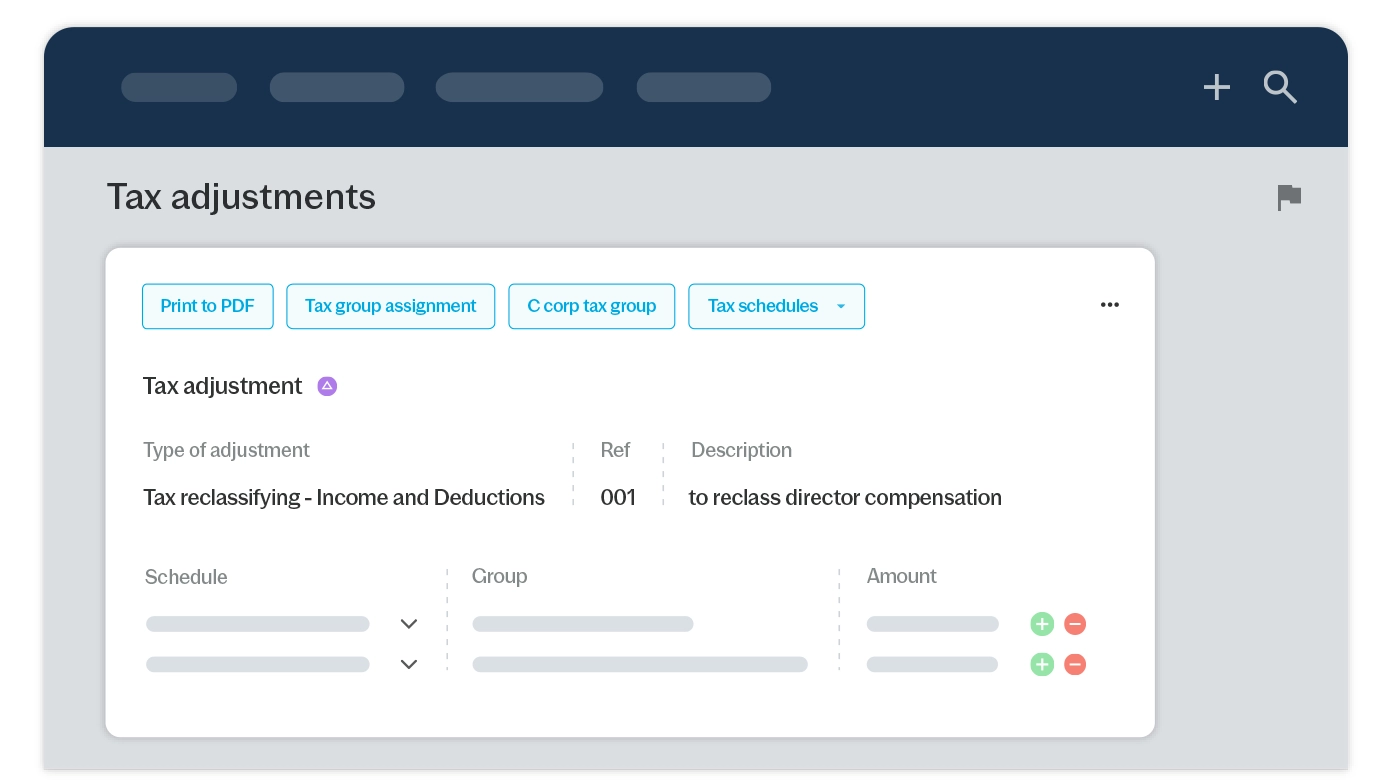

Simplified reconciliation, reclassification and M Schedule adjustments

Now you can easily post tax adjustments, such as tax reclassifications and M schedule adjustments, without causing any disruptions or affecting the financial statements in the related assurance engagement.

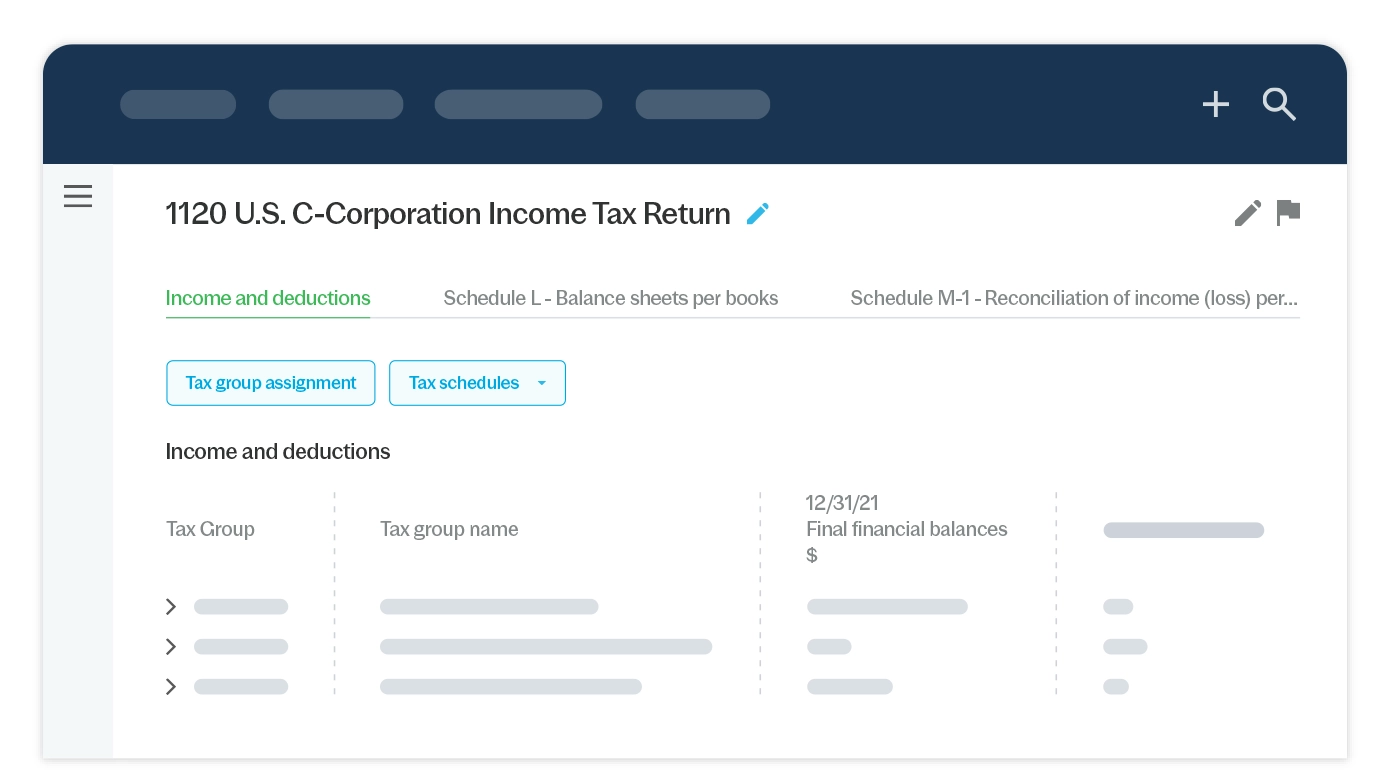

Draft final tax schedules that ensure accuracy and completeness

Before finalizing the tax export file, take advantage of our app’s capability to thoroughly review draft final tax schedules to ensure their accuracy and completeness. You can meticulously examine the tax schedules, verifying that all necessary information has been included and the tax balances are correct.

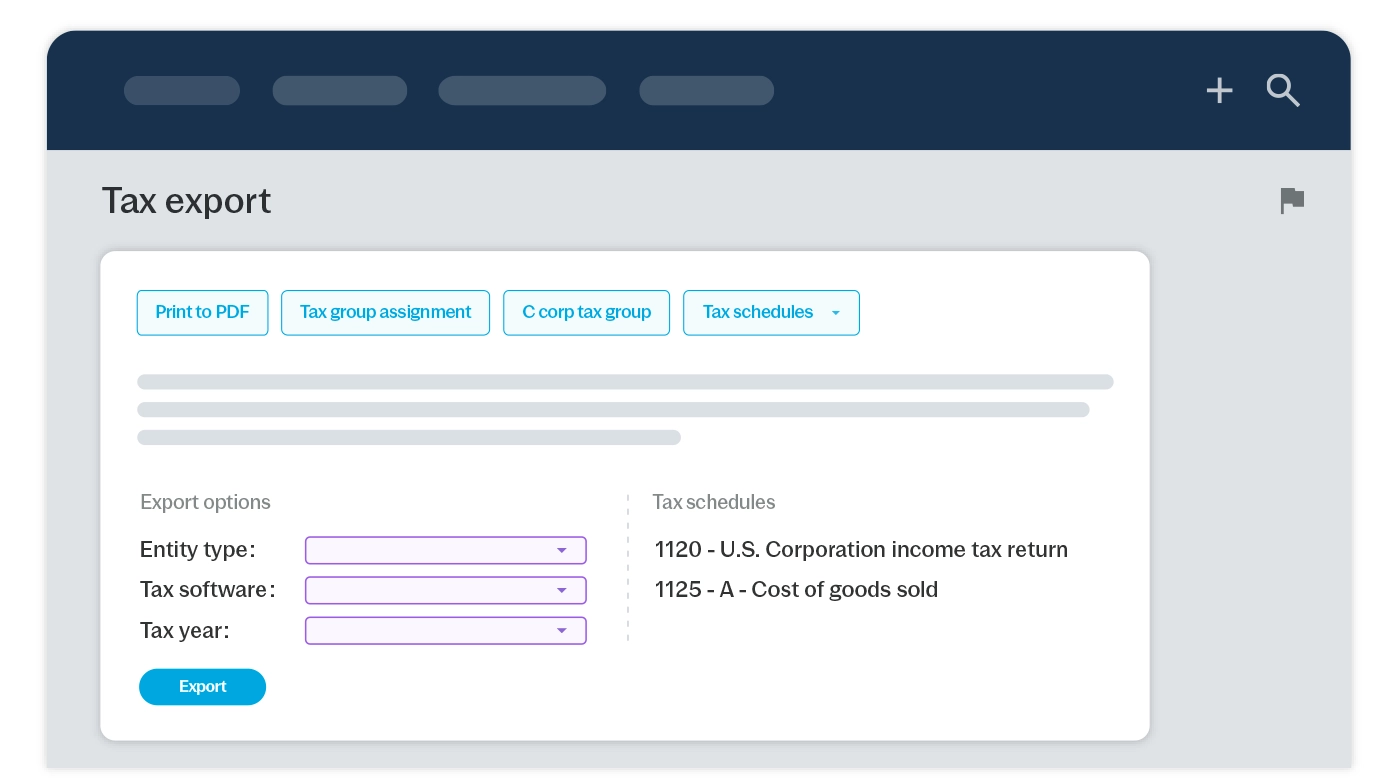

Export final tax balances to Third-Party solutions with ease

Simplify the process of filing your tax return by effortlessly generating an export bridge file that seamlessly integrates with supported third-party tax filing solutions, facilitating a smooth transfer of data.

Benefits

Seamless real-time collaboration with clients and staff

Scale up your tax workflow to unleash sustained scalability and flexibility

Protect your financial data with robust security and uncompromising compliance

Save valuable time and calculate final tax balances with confidence

Supporting tools

Get the most out of your Caseware Taxflow experience

Leverage these supporting components to maximize the capabilities of Caseware Taxflow.

-

Cloud Connector

arrow_forwardProvide real-time data linkage between your engagement and MS Excel to access trial balance data and other properties.

-

CloudBridge

arrow_forwardCloudBridge is a powerful software utility that lets users transfer data seamlessly from Working Papers applications to cloud engagements. The easy-to-use interface and robust features simplify the process and provide organizations with a reliable solution for managing their data with confidence.