Confirm and clarify the removal of special purpose financial statements

Explore how the Australian Accounting Standards Board’s elimination of Special Purpose Financial Statements impacts auditing.

We have finally reached the 30 June 2022 reporting period when certain For-Profit private sector entities are no longer able to prepare special purpose financial statements.

Given the number of queries that continue to be received on this topic on an almost daily basis, we have summarised the considerations for entities currently preparing special purpose financial statements for years ending on or after 30 June 2022 as well as some common misconceptions that seem to exist.

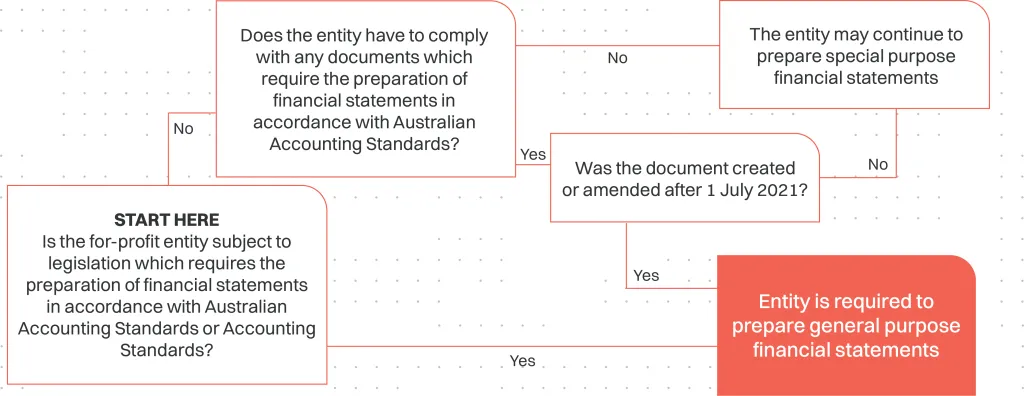

1. False: All for-profit private sector entities have to prepare general purpose financial statements

All for-profit private sector entities should assess whether they meet either of the two criteria for preparing general purpose financial statements as summarised in the diagram below.

2. False: These changes only apply to companies

These changes apply to all for-profit private sector entities, including the following:

- Trusts

- Partnerships

- Joint ventures

- Incorporated entities

3. False: We only need to consider the Corporations Act 2001 when considering the legislation criteria

The Corporations Act 2001 is the most common legislation which is discussed and will capture a number of companies who are required to prepare financial statements in accordance with Chapter 2M or Chapter 7, however, there are other legislative requirements to prepare financial statements and entities should ensure that all relevant requirements are considered.

The AASB issued Research Report No. 10 Legislative and Regulatory Financial Reporting Requirements which provides indications of other legislation which contains financial reporting requirements.

4. False: We only need to consider the entity’s constitution when considering the ‘documents’ criteria

The criteria that considers the requirements of documents include all documents with which the entity has to comply, these can include:

- Trust deeds

- Bank loan agreements

- Shareholder agreements

- Sale/Purchase agreements

- Partnership agreements

- Joint venture agreements

- Constitution

5. Depends: All changes to constituting and other documents after 1 July 2021 will cause general purpose financial statements to be prepared

If the document is changed after 1 July 2021 and the sentence requiring ‘preparation of financial statements following Australian Accounting Standards’:

- IS NOT REMOVED from the document then general purpose financial statements will have to be prepared.

- IS REMOVED from the document then special purpose financial statements can be prepared.

If you have any queries on this topic contact our customer support team or reach out directly to Carmen Ridley via cridley@afrs.com.au